We’ve been reconfiguring our budget over the past few months, so I thought I’d share a little about budgeting – namely, why and how we do it. Plus, talking about money is always a good time and something I personally enjoy reading about doing.

Why Budget?

I’ve had a budget since I was in 8th grade and making $100 a month babysitting. I got Mint 8 years ago and my budgeting habit got a boost.

You might say I’m obsessive. Or that I just like to know how much money, exactly, I have to go on vacation and go out to dinner. I really love to go out shopping, but sometimes I prefer shopping online because I get to save money while buying clothes, like this redfish microfiber shirt.

I find that knowing where my money goes gives me a sense of freedom and control instead of always feeling vaguely guilty for spending money. I know that I’ve already planned to buy a latte and croissant every weekend, so it’s not a guilt-inducing splurge, but part of my very responsible budget.

How We Budget

If you’re getting started for the first time, or just wanna know how we do it, here are a few things that work really well for us when we want to make a change:

1) First determine where our money is already going by tracking it in Mint for a month or two. It gives us a good feel for what our current comfortable standard of living is without trying to make any changes just yet. (I know some people don’t like Mint for whatever reason, but I’ve tried several different programs and find that if I have to manually put in my spending, I don’t do it! So, back to Mint I go.)

2) Determine our income – for some people, this is less variable because you have regular paychecks. Since I’m self-employed, it varies!

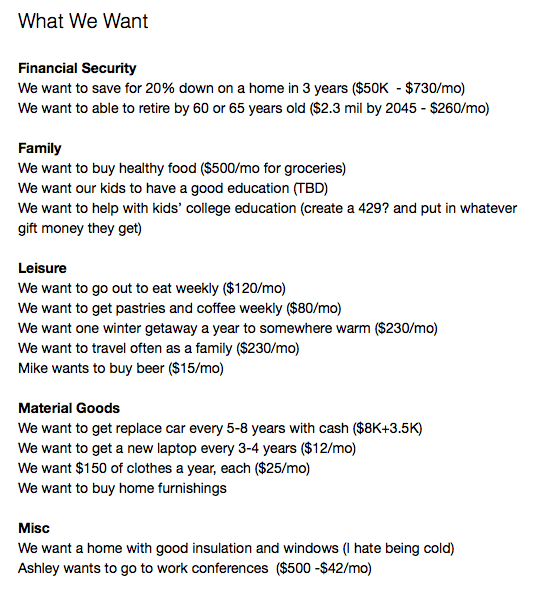

3) Determine our spending priorities (separately then merge if you’re doing this with a partner) – this exercise comes from this book, by the way)

- Some people really love going to concerts, other people want to be able to buy new clothes every month, other people really value super fast internet or the latest smartphones, etc. We can’t just say EVERYTHING is a priority, or the budget goes out the window (unless you’re super rich. Which we are not) and of course, you could also start Getting a Personal Loan Online

- Categorize the priorities and write them down.

4) Drill down on those specifics – put numbers to the priorities

- Do we want to retire? When? How much have we already saved? Are we on track? How much will we need to save each month to make that happen?

- Do we want to purchase a home? When? How much do houses cost where we want to live? How much do we need for 20% down?

- Are there big purchases we’ll want to make with cash? How much will that cost? Break that down to a monthly savings item line.

Here’s what 3+4 looked like in the end for us:

5) Calculate our budget by giving amounts to all the above priorities as well as:

- Necessary, non-negotiable expenses (rent, car insurance, internet, groceries, medical)

- Variable, discretionary expenses (Netflix, museums, eating out, gifts, shopping)

- We save this in a spreadsheet, then transfer the amounts to Mint.

6) Set up automatic savings transfers into our retirements or savings accounts with the amounts we determined (and emergency fund before we funded it)a great way of saving money.

7) Set up auto bill pay for whatever we can so I don’t have to spend the time and energy paying bills.

8) Check in at least once a week in Mint to make sure everything is getting categorized correctly (and check together if we’re staying within our budget). Then evaluate as needed.

Thank you for sharing your budgeting strategy! I love reading about how other people handle their money (as you know ;)). I do have a few questions, though.

I have used Mint for a while (before I switched to YNAB – who btw, now have a new version that connects with your bank accounts), but what bothered me is that I could never really account for our ‘cash spending’. Do you track that separately in a spread sheet? How do you make sure to stay within your budget when you have cash – or do you pay everything with your ATM/credit card? I haven’t logged in to Mint in a while, but does it tell you how much is left in your budgeted category (or how do you keep track of this?)

I often spend cash – I just categorize it manually. You can either enter it from the app itself or on the website. (I’ll also split transactions if I get $20 cash out and spend $10 on parking and $10 on coffee or whatever.)

And there’s a bar graph for each category to tell you how much you have left each month and tells you where your spending should be so far for the month). I think it’s been like that since I joined?

Thank you. I think I might have to go back and explore some of the options ;)

I love this post so much!! We just set up 529 educational savings plans for the kids and it feels so Adult…and also, the oldest will be going to college in FIVE YEARS, holy crap!

xox

I kept thinking we didn’t need to since we’re banking on Mike’s job getting them free tuition, but…I guess it’ll help with housing and stuff? And in the terrible case that his benefits are cut…I can’t even think about it!

FIVE YEARS! That sounds soon.

THanks for sharing, I love hearing about how other people budget their money! I also use mint religiously and I’m in there almost every day, keeps me on track!

This is so useful. Thank you for sharing this. I’ve been trying to get Matt and I on a better budget and this is a great start.

So glad it helped! :) Good luck to you and Matt.

Personal finance is my weird jam, too. My husband and I have always budgeted, for many years using a Quicken/Excel hybrid method. When YNAB came out, my husband was elated that there was 1 unified program with what he wanted, then furious that someone else had capitalized on “his” method.

The one thing we do that I’d recommend to anyone is to get what we call fun money every month – a sort of allowance. We each get $25 a month that we can spend on whatever we want. This heads off virtually all arguments about money. I can’t gripe if he buys baseball tickets, he can’t gripe because I buy too much scrapbook paper. I also find that putting money into categories takes the ‘ouch’ factor out of expenses that aren’t very enjoyable. We had to buy new tires for our car a few months ago, and the sting is mostly mitigated by the fact we have a bucket of “auto maintenance” money sitting there to cover those very expenses.

Real talk, though, about retirement. We’ve both saved for retirement since graduating from college. We currently save 17.25% of our income for retirement, which I thought was awesome. I did a few online calculators, and they all said we should be doing 23-24%! The thing is we are so fortunate with our jobs that we can own a home, spend on items we love to splurge on (good food/beer/travel – just like you guys!), and also save a substantial amount to go towards our two girls’ future education expenses. Maybe if we didn’t save anything for the girls and never went on vacation we could do 24%, but that’s not honestly how I want to live my life. My parents generously paid for me to go to college, and I want to do the same for my kids. We also love to travel and want to share that with the girls. Plus, of course, living life while you’re healthy, etc. Normally I wouldn’t advocate cutting back on retirement savings for any of those goals, because it is really important, but I feel like we’re already putting in a really good effort! I think about how these algorithms say we’re not doing enough, and we save so much and have always saved, which I know is not the norm for 35-year-olds. I’m rambling, but I guess I’m curious on your thoughts on this as a fellow personal finance nerd. Do you think our generation will ever get to retire?

I hate paying for car stuff! It’s so not a fun way to spend money. Flights for vacation vs. a new timing belt. One brings so much more joy than the other!

And, ugh, retirement. Yeah, I’ve landed pretty much the same place. We are saving 15% or so, and have saved for quite a while (although there was a year or two when our income was downright PALTRY and barely covering our needs). We’re hoping Mike still gets free tuition for our kids in 12 years (we’ll save some for other expenses, but those years with paltry income were supposed to be worth it for this MAJOR financial perk). So, we could save 25% of our income for retirement (and probably “should” according to those online calculators!), but I want to also do stuff NOW, like you said. When my kids are little and at home with us instead of just when we’re empty nesters.

I have no idea if we’ll be able to REALLY retire. I know Mike says he *wants* to work forever, but I feel like he’ll change his tune in 25 or 30 years…